CLST Markets, an institutional-only lending and borrowing venue for stablecoins and crypto assets, has successfully facilitated an uncollateralized multi-million USDC stablecoin loan executed by Amber Group for the first time today. The fixed-term transaction was executed in the form of the first electronic promissory note for a stablecoin issued on the Algorand Blockchain.

Swiss-based FinTech company CLST led the successful transaction between Amber Group and an undisclosed counterparty. The underlying asset, a USDC stablecoin issued on the Algorand Blockchain (commonly referred to USDCa), was settled Peer-to-Peer and is based on an electronic promissory note (eNote), a technology provided by FQX which is seamlessly integrated into CLST. The multi-million USDC stablecoin loan was borrowed by Amber Group at a Fixed Term and with a contract duration of less than a year.

An eNote™ is an unconditional promise to pay a specific sum to another party at a specific future date and can be modularly structured to fit any financing purpose. The eNote™ is based on blockchain technology and can be easily transferred to any third party (i.e. an investor). When compared to other financing tools, eNotes™ excel through their modularity and global transferability, based on a standardized legal framework. Single eNotesTM are stored as NFTs on a blockchain. By issuing multiple eNotesTM, an issuer can obtain financing in a way comparable to commercial papers.

The uncollateralized transaction marks a significant milestone in institutional crypto asset lending by solving the problem of over-collateralization. Borrowers are routinely forced to pledge an amount of collateral that exceeds the value of the loan to mitigate the risk of cryptocurrency price fluctuations. This impediment is holding back the development of borrowing and lending in the crypto asset industry.

Overcoming this obstacle, whilst keeping risk at manageable levels, will finally allow institutions to unlock the full potential of a maturing short-term debt market as TradFi and DeFi converge.

Counterparty risk is mitigated by the innovative use of electronic promissory notes, a tried and tested method of providing lenders with a globally enforceable legal provision in the event of loan defaults.

Lack of institutional-grade infrastructure in lending and borrowing

“Currently, the institutional short-term debt market for stablecoins and crypto assets is heavily underserved due to a lack of large-scale lending and borrowing infrastructure that reduces counterparty and DeFi protocol risks. We are doubling down on the vision to connect every institution, from market makers, to treasuries, foundations, family offices or hedge funds, through a single communications venue,” says Michael Guzik, Founder and CEO of CLST.

“As a leading digital asset platform, Amber Group helps its clients to access liquidity, earn yield, and manage risk across crypto assets. As an institution with a global footprint, access to broad networks of lenders and borrowers, are therefore essential to Amber’s trading activities and liquidity management. Michael and the team behind CLST will make uncollateralized lending and borrowing more efficient through the aggregation of deal flow and we are excited to be part of this global network at the very beginning of a new future for crypto assets in the market,” says Francesco Adiliberti, Managing Director for Europe at Amber Group.

About CLST

CLST is the institutional communications venue to lend or borrow stablecoins and crypto assets, automating multi-dealer price negotiation and price matching for institutional traders. CLST Markets integrates next generation products such as “Request-for Quote” (RFQ), “Fixed Term”, “Call Money”, institutional DeFi protocols, blockchain-based electronic promissory notes and wallet connectivity for automated settlements. CLST aims to resolve market uncertainties and scaling issues in uncollateralized and collateralized lending and borrowing of stablecoins and crypto assets. For more information, please visit www.clst.com

*Disclaimer: CLST borrowing and lending capabilities and products of stablecoins and crypto assets are not yet available in the United States.

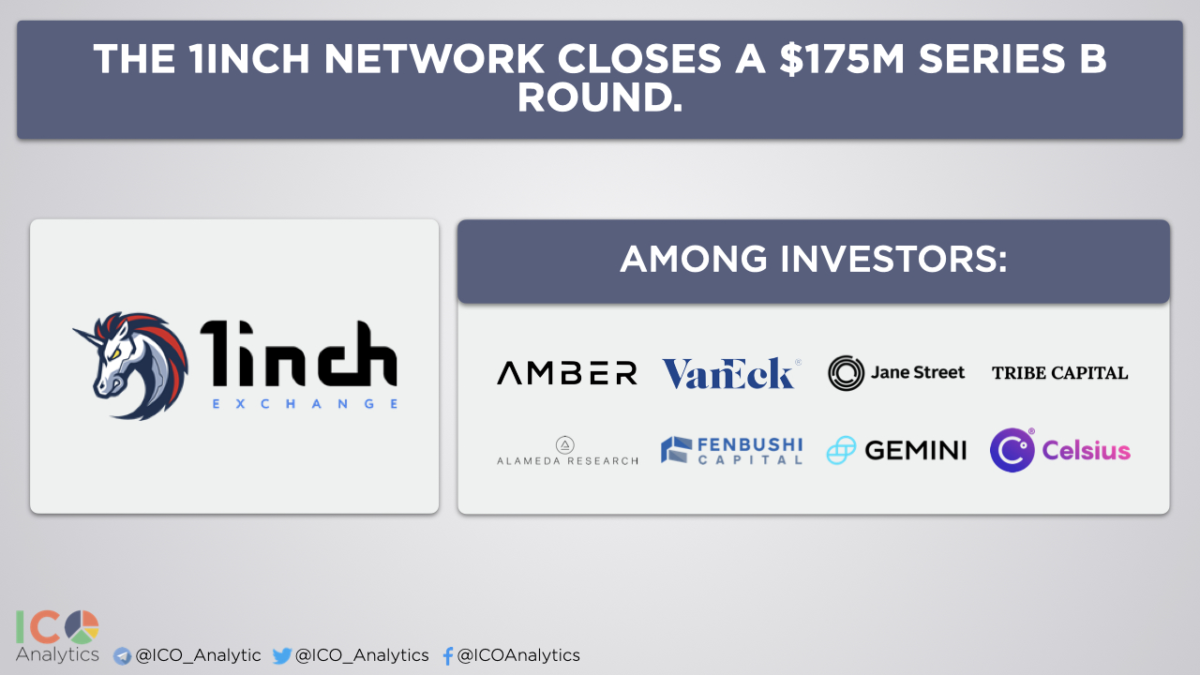

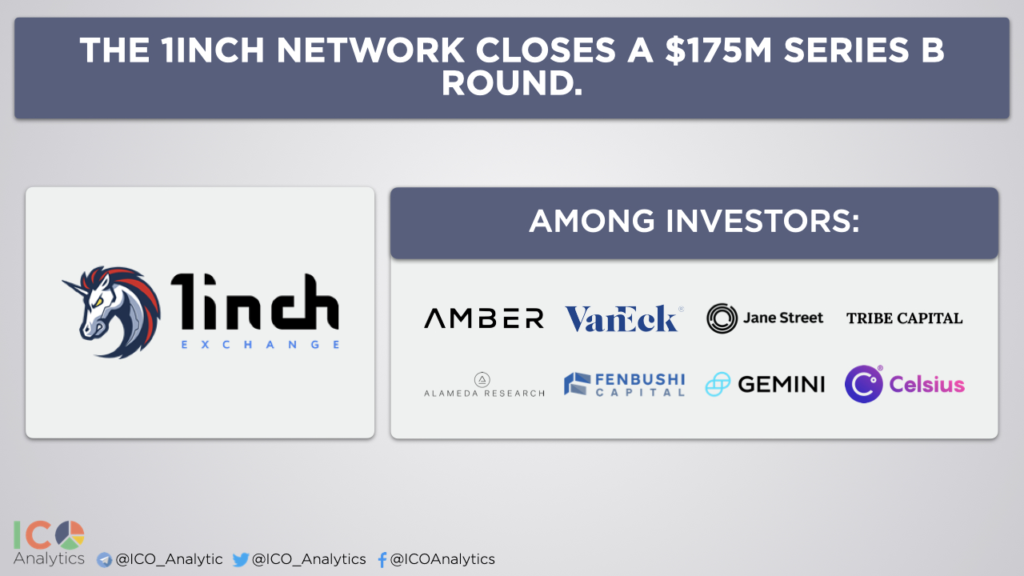

About Amber Group

Amber Group is a leading digital asset platform operating globally with offices in Asia, Europe, and the Americas. The firm provides a full range of digital asset services spanning investing, financing, and trading. Amber is backed by prominent investors including Sequoia Capital, Tiger Global Management, Paradigm, and Coinbase Ventures. For more information, please visit www.ambergroup.io

About FQX

FQX is a born-global start-up headquartered in Zurich, Switzerland. FQX is building the global debt infrastructure for the future of finance using blockchain technology. FQX employs more than 20 people in Europe & Asia. FQX has garnered attention in 2021 by winning the Swiss Fintech and the Fintech Germany Awards in its respective categories. FQX is backed by notable Fintech investors, among them SIX Fintech Ventures & Earlybird VC.

For more information, please visit enotes.tech

Media Contact

Stella Wang

Alex von Mühlenen

alex.vm@clst.com

Jörg Röthlisberger

info@glt-communications.ch