Nairobi, Kenya – May 17, 2024: Bitget, one of the leading digital asset trading platforms, has officially launched its highly anticipated KCGI 2024 trading competition. This year’s event promises to be bigger and better, with a massive prize pool and exclusive rewards designed to attract the best trading talents from across the globe, including Africa.

What is KCGI?

The King’s Cup Global Invitational (KCGI) is an annual trading competition organized by Bitget, known for its robust trading services and innovative features. The competition is structured to include various segments such as Team Battles, Individual Competitions, and the Newcomer Challenge, providing multiple avenues for traders to win substantial rewards.

Highlights of KCGI 2024:

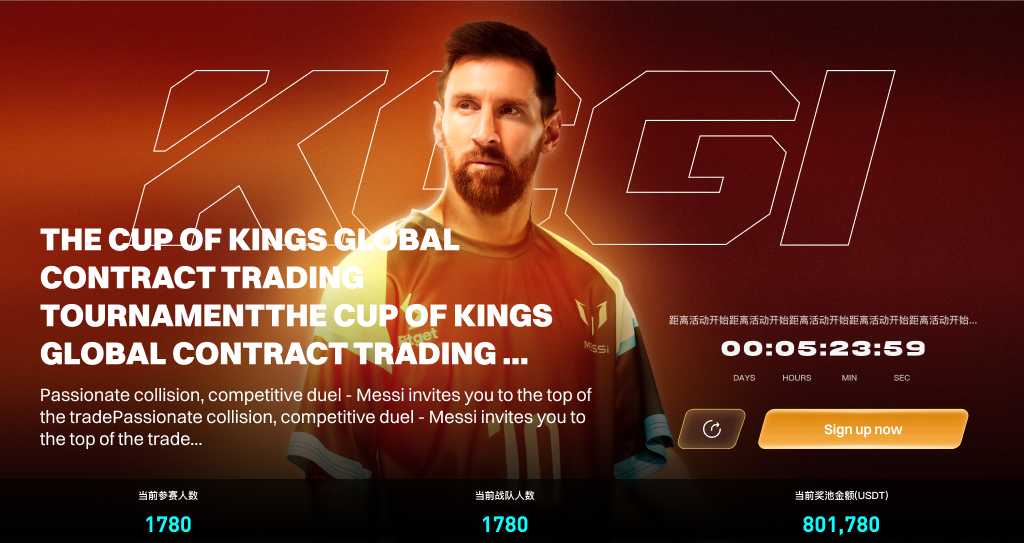

- Event Period: May 15 to June 27

- Prize Pool: Starting at 100,000 USDT, potentially reaching up to 5,000,000 USDT

- Special Prizes: Including a Ferrari, a Messi-signed jersey, and daily rewards

Key Dates:

- May 17: Team registration begins

- May 24: Early bird participants can join teams

- June 7: Late registration for the futures trading competition

Rewards and Incentives

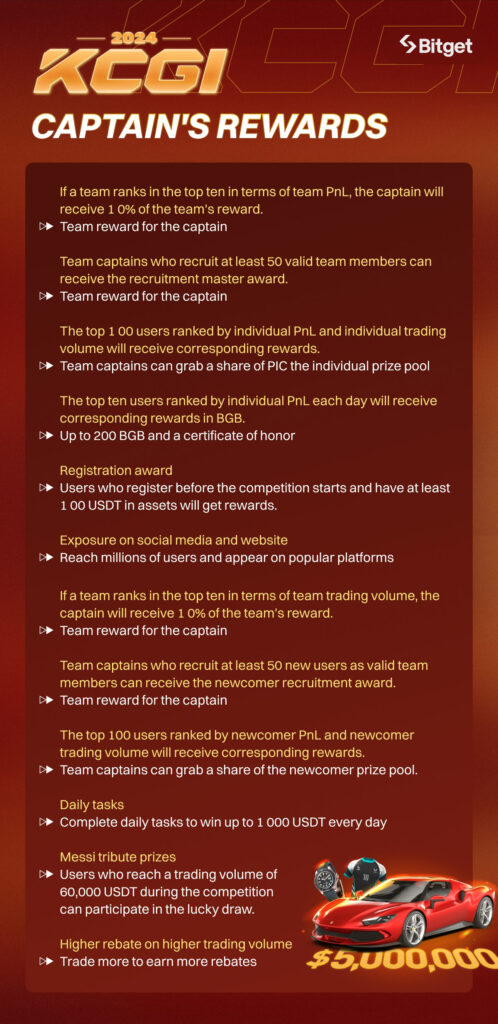

For Team Captains:

- Captains of teams ranking in the top ten in terms of team PnL or trading volume will receive 10% of the team’s reward.

- Captains recruiting at least 50 valid team members can earn the Recruitment Master Award.

For Individual Traders:

- The top 100 users ranked by individual PnL and trading volume will receive corresponding rewards.

- Daily tasks with rewards up to 1,000 USDT each day.

- Special Messi tribute prizes for those reaching a trading volume of 60,000 USDT during the competition.

Special Offer for Kenyan Captains:

- The first 10 captains from Kenya who set up teams with 10 people will qualify to get $100 courtesy of SatsDaily. To be eligible, captains need to complete a Google form.

Reflecting on KCGI 2023

Last year’s KCGI was a resounding success, attracting 7,467 participants worldwide. The competition saw intense battles in both the Individual and Team categories. Chrwin from the English Division emerged victorious in the Individual Competition with an outstanding profit of 467,614.2 USDT. The BMoster team dominated the Team Battle, earning a total profit of 51,130.31 USDT. Participants praised the event for its competitive spirit and the platform it provided to showcase their trading capabilities.

James Lee, Bitget’s Global Strategy Officer, commented on the event’s impact, “As a global exchange, Bitget is proud to offer a platform where the world’s best traders can shine. We are committed to making KCGI a regular feature, expanding our reach, and furthering the development of digital trading.”

Join the Competition

African traders are encouraged to seize this opportunity to participate in one of the largest and most prestigious trading competitions in the digital asset space. Bitget aims to provide African traders with the resources and platform they need to succeed.

To register and find out more about KCGI 2024, visit the Bitget KCGI 2024 page.

About Bitget

Bitget is a leading digital asset trading platform, renowned for its user-friendly interface, comprehensive trading services, and commitment to security and transparency. The platform serves millions of users worldwide, providing a reliable environment for trading a variety of digital assets.

Stay tuned for more updates and support throughout the competition. Let’s gear up for glory together and show the world the trading talent that Africa has to offer!