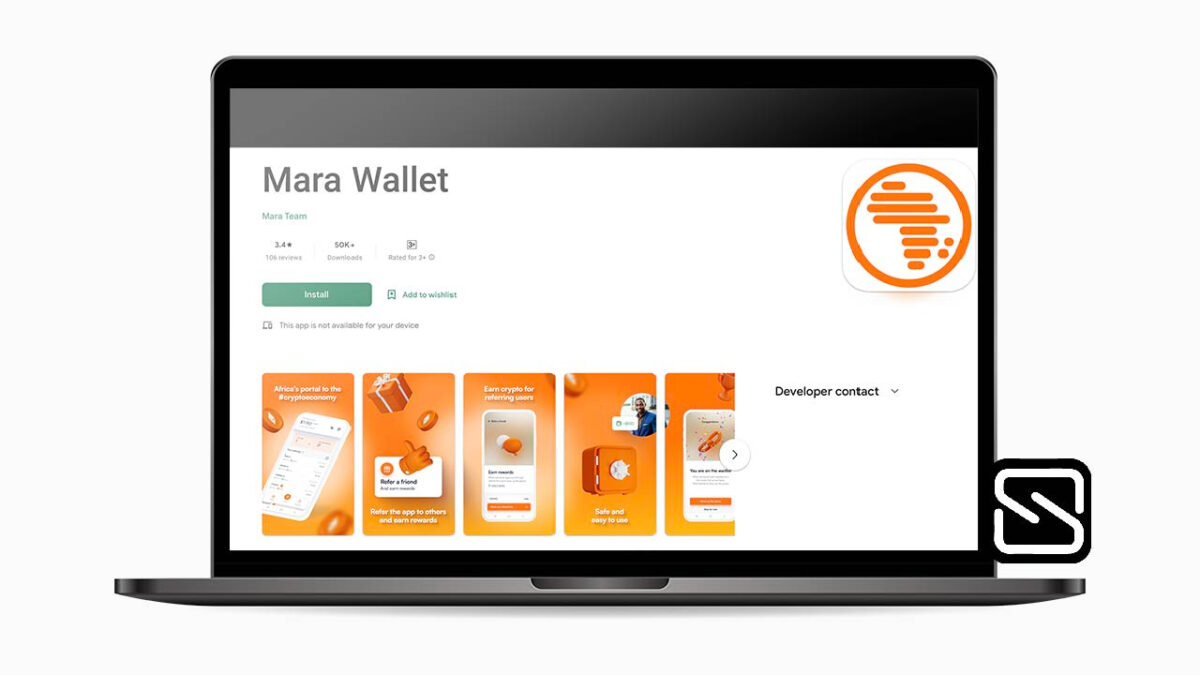

The pre-launch of the Mara Wallet, a portal to the crypto economy, has been announced by Mara. Mara is a pan-African company that provides an ever-growing suite of cryptocurrency products. The company is focused on assisting people in starting their crypto journey toward conveniently managing their crypto-finance needs, taking a significant step toward financial freedom, and learning more about cryptocurrency and blockchain in Africa.

Africans can now control their bitcoin thanks to the Mara Wallet, a quick and secure multi-currency wallet.

Offering both user-facing products and core infrastructure, Mara reveals a product roadmap that enables users to easily buy, sell, send, withdraw, store, and protect a wide range of fiat and crypto-assets such as cryptocurrencies and NFTs in real-time and without any prior crypto knowledge.

“At Mara, we are committed to the financial empowerment of the individuals that use our products and services to meet their various crypto-finance needs, and take responsibility in building an informed community seriously,” Chi Nnadi, Co-Founder and CEO at Mara, said while commenting on the pre-launch of the Mara Wallet.

He adds that “As one of our first steps to achieve crypto education, financial literacy, and ensuring a more equitable distribution of capital, we are delighted to pre-launch the Mara Wallet. Our goal is to get Sub-Saharan individuals started on their journey to leverage a financial infrastructure that they can build their lives upon and make the most of the financial-growth opportunities available in the crypto economy.”

Mara will initially launch in Kenya and Nigeria, with its first product being the simplified user-friendly Wallet through which users can easily buy, sell, send, and withdraw cryptocurrencies.

The main feature of the pre-launch app, the Mara Wallet waitlist, is intended for both crypto-curious and crypto-enthusiast users who want early access to the exchange. Through it, users will be able to get financial benefits that provide the ideal launchpad into the crypto economy.

While describing how the Mara Wallet waitlist works, Chi said, “Pre-registered users will join a queue to enable early access on a first-come, first-served basis. Moreover, a higher position on the waitlist increases the odds of periodically winning prizes. As soon as users join the waitlist, they instantly earn a signup reward. All users who refer the Mara Wallet to their friends, family, and community also earn further rewards when those users sign up using their unique referral link. Pre-registered users who participate in the referral activity also improve their chances of moving to top positions on the waitlist.”

The pre-launch of the Mara Wallet comes at a pivotal moment in Sub-Saharan Africa’s development. The current centralized banking system continues to be a barrier to the growth of local economies and of people as well. As a result, food prices have doubled or even tripled in some areas and created record-breaking interest rates. These systems have prompted a dire need for a decentralized alternative.

The Mara Wallet app is available on the Google Play and Apple App stores. Once formally launched in a few months, the Mara Wallet will enable users to invest in crypto and send money to their family members in real-time without processing times, delays, or high fees. To join the waitlist, download the app on Google Play or the Apple App Store.

Mara’s mission is to facilitate more equitable distribution of capital by providing an alternative that cuts across tribes, classes, cultures, and countries.