Blockchain and Artificial Intelligence (AI) are two equivalently important and emerging technologies. According to some experts, blockchain is versatile and easy to apply whereas AI has surpassed all its limitations as experiments have shown. Some emphasize that both are often embedded with recent technological developments, albeit they both have different roots.

Additionally, most developers claim that blockchain technology and Artificial Intelligence (AI) are two distinct but complementary fields. Both are considered cutting-edge technologies that have the potential to revolutionize the way we live and work. However, they can also be combined to create powerful new solutions.

Defining blockchain and AI

According to Investopedia, a blockchain is a distributed database or ledger that is shared among the nodes of a computer network. As a database, a blockchain stores information electronically in a digital format. Blockchain technology is best known for its crucial role in cryptocurrency systems, such as Bitcoin, in maintaining a secure and decentralized record of transactions. The innovation of blockchain is that it guarantees the fidelity and security of a record of data and generates trust without the need for a trusted third party.

On the other hand, Artificial intelligence (AI) refers to the simulation of human intelligence in machines that are programmed to think like humans and mimic their actions. The term may also be applied to any machine that exhibits traits associated with a human mind such as learning and problem-solving. The ideal characteristic of artificial intelligence is its ability to rationalize and take actions that have the best chance of achieving a specific goal.

In other words, the main difference between blockchain and AI is that blockchain is used to store data in a safe and decentralized manner while AI is tasked to make artificial objects smart like humans for example smartphones that can have programmed fingerprints and the new and trending AI language model, Chat GPT, an AI Chatbot introduced by Open AI.

Similarities between the two

According to some sources, blockchains and AI have combined values and the two can be interlinked in some way, here’s how;

- Blockchain’s digital record offers insight into the framework behind AI and the provenance of the data it is using, addressing the challenge of explainable AI. This helps improve trust in data integrity and, by extension, in the recommendations that AI provides. Furthermore, using blockchain to store and distribute AI models provides an audit trail, and pairing blockchain and AI can enhance data security.

- AI can rapidly and comprehensively read, understand and correlate data at incredible speed, bringing a new level of intelligence to blockchain-based business networks. By providing access to large volumes of data from within and outside of the organization, blockchain helps AI scale to provide more actionable insights, manage data usage and model sharing, and create a trustworthy and transparent data economy.

- AI, automation, and blockchain can bring new value to business processes that span multiple parties, removing friction, adding, speed, and increasing efficiency. For example, AI models embedded in smart contracts executed on a blockchain can recommend expired products to recall, execute transactions such as re-orders, payments, or stock purchases based on set thresholds and events resolve disputes, and select the most sustainable shipping method.

Can the two complement each other?

While blockchain and AI are known to have functioning individually and independently, the two technologies are more intertwined than ever in recent times. One such area where the combination of AI and blockchain would serve as the ideal model is data handling. The combination helps deal with data-related issues by breaking down the data into smaller parts in a blockchain, which is then distributed across the network.

This model can solve some of the major issues for businesses from various industries. While AI can enhance the performance, accuracy, and efficiency of the data, blockchain can run computer networks by looking for power and energy.

According to Eng. David Lumala, a Ugandan developer and blockchain expert, the complement exists and is quite palpable. He emphasizes that many blockchain companies, have imbued AI in their operations and this is their way of maximizing the opportunities technology offers.

“I’d give an example of bubble.io and LensAI,” he notes.

He further adds, “AI is most appreciated in operations with repetitive tasks. Blockchain often captures data where there is a defined pattern. AI then helps by automating this process. See for example the language model, ChatGPT, where Google will give you a billion answers, ChatGPT will give you a brief and precise response.”

While AI and blockchain are a new age of technology, these fields offer so many opportunities for young people currently. Unfortunately, only a small portion of African countries actively participate in AI and blockchain. Although there are attempts to increase awareness, there is still a massive stereotype hindering fast adoption.

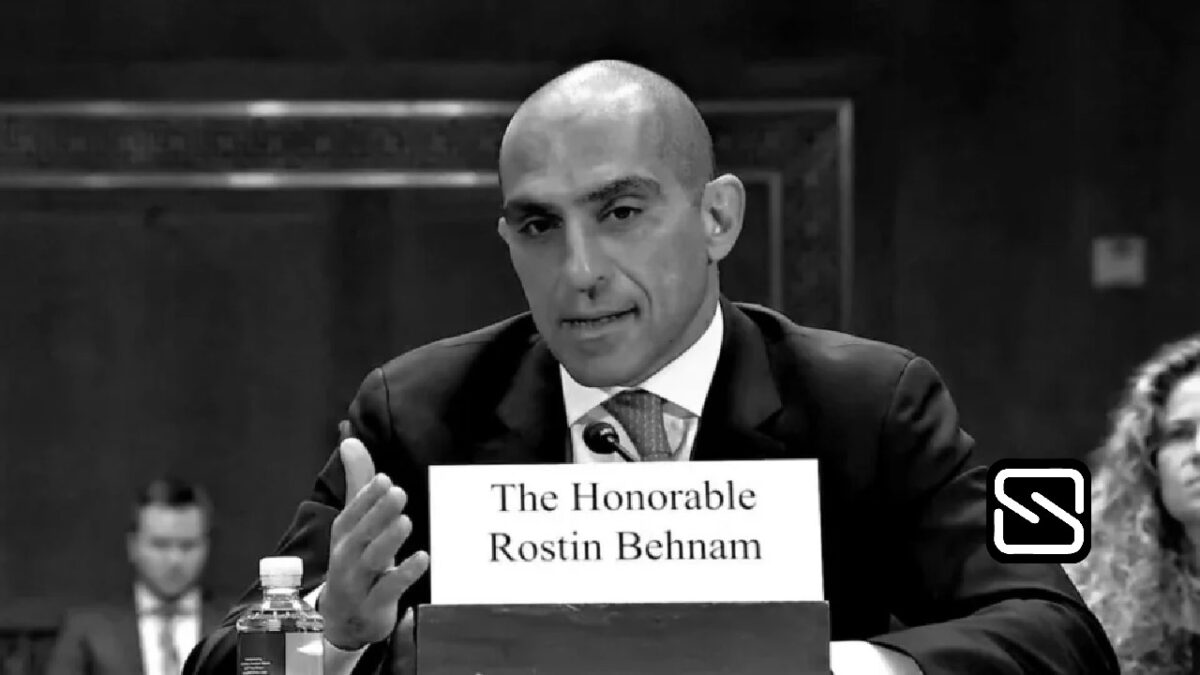

Through Blockchain 360, Uganda will be hosting a blockchain conference at the Uganda Institute of Information and Communications Technology (UIICT) in Nakawa, on 18th March. The event will further demystify the ever-changing and disruptive technologies including, blockchain, AI, and Web 3.0. The conference is anticipated to bring together experts, entrepreneurs, local developers already building DApps and virtual worlds, and legal practitioners in the blockchain field. To participate, register via: https://www.eventbrite.ie/e/blockchain-360-tickets-541708062397.