EOS Network Ventures has committed $20 million in capital to develop applications and gaming products on the EOS network after April’s Ethereum Virtual Machine (EVM) launch.

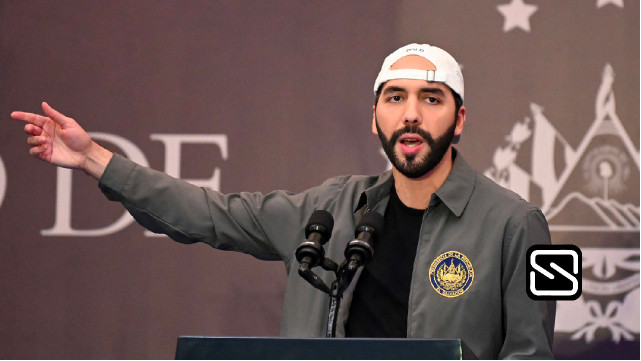

“EOS Network Ventures (ENV) is making a formal commitment to invest $20M directly into $EOS EVM and GameFi projects. EOS EVM will also have the most funding available for builders,” EOS Foundation CEO Yves La Rose opined.

“With $20M up for grabs for EVM projects, we expect a massive influx of developers who want to take advantage of the funding opportunities,” La Rose said, adding the commitment was made to attract developers and builders to the EOS blockchain in the coming months.

EOS is gearing up for its second innings with a funding push ahead of April’s EVM launch. EVMs refer to the environment in which all Ethereum accounts and smart contracts live, serving as a virtual computer utilized by developers for creating decentralized applications (apps).

When deployed on other blockchains, EVMs can allow developers to build dapps and decentralized finance (DeFi) applications similar to how they would on Ethereum.

According to Coindesk, such moves are thanks to the efforts of La Rose, who is leading plans for a consensus mechanism upgrade, an Ethereum Virtual Machine (EVM) system and an overall renewed growth strategy.

Market participants have long criticized and scrutinized EOS for earning $4 billion in its initial coin offering (ICO) with little to show in its early years in terms of both usage and technological development.

The increased effort may ultimately increase the price of EOS tokens in the upcoming months and increase the value of decentralized applications built on EOS.

Users are spoiled for choice in an increasingly competitive crypto market, however, as relatively newer networks such as Arbitrum, zkSync, Optimism and Solana, among several others, vie for developer talent and increase their own revenues via token incentives or airdrops.