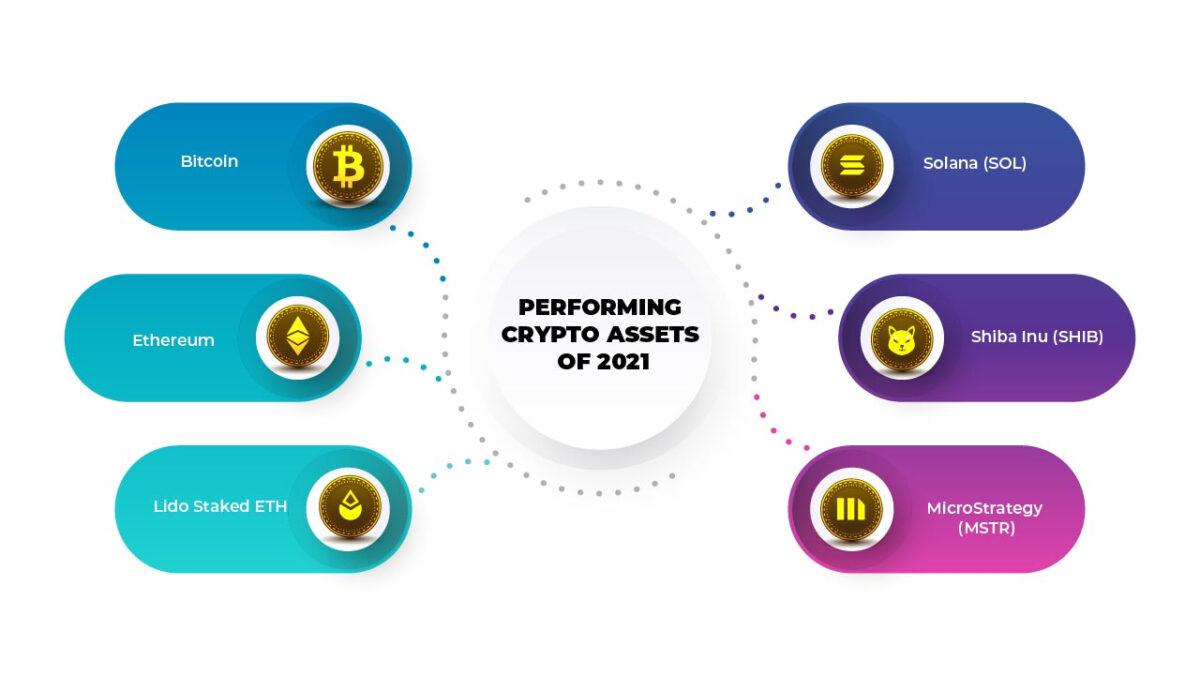

2021 was a fair year for everybody else but a great year for crypto currencies. Crypto’s growth into a multi-trillion dollar asset has been aided by a number of high-profile organizations and businesses participating in it on a significantly larger scale than previously seen. The two most valuable cryptocurrencies, Bitcoin and Ethereum, hit fresh all-time highs, and El Salvador became the first government to accept cryptocurrency as legal tender.

On 5 November, the Bitcoin price hit an all-time high of $68,000 (about 240 million Uganda Shillings), a significant increase from the $28,000 level it was trading in December last year. The crypto market, on the other hand, has taken a beating. Cryptocurrencies are still a relatively young alternative asset class, and volatility is projected to be a feature of the market for the foreseeable future. Fintech and traditional payment companies began to embrace blockchain and crypto solutions, with PayPal, Venmo, Mastercard, and even Twitter allowing clients to make Bitcoin transactions.

Massive growth and large market cap gains were seen in digital assets and crypto firms, confirming the sector’s maturity. Coinbase began in 2021 as the world’s largest digital asset listing, with a market capitalization twice that of Nasdaq. This has been beneficial to the industry, as it has increased openness and confidence. The presence of such a large public corporation demonstrates that crypto-related enterprises – and the crypto asset class – should be considered seriously. The cryptocurrency market is currently worth more than $3 trillion.

El Salvador became the first country in the world to recognize Bitcoin as legal tender, which implies that businesses must accept it as payment. The decision drew both praise and condemnation, but it confirms the usefulness of cryptocurrencies as a method for developing economies to sidestep a global financial system that is based on unfavorable loans and aimed toward the world’s wealthier countries and individuals.

We’ve seen efforts to regulate cryptocurrency all around the world. South Africa’s regulators have chosen a pragmatic approach to crypto regulation, announcing draft legislation in 2021.

A number of central banks throughout the world have issued digital currencies. In 2021, Nigeria re – launch the e-Naira, and South Africa is looking towards creating a digital currency.

As the industry becomes more well-known, it is attracting top talent from throughout the world. Users are becoming more knowledgeable about cryptocurrency and how to keep their funds safe.