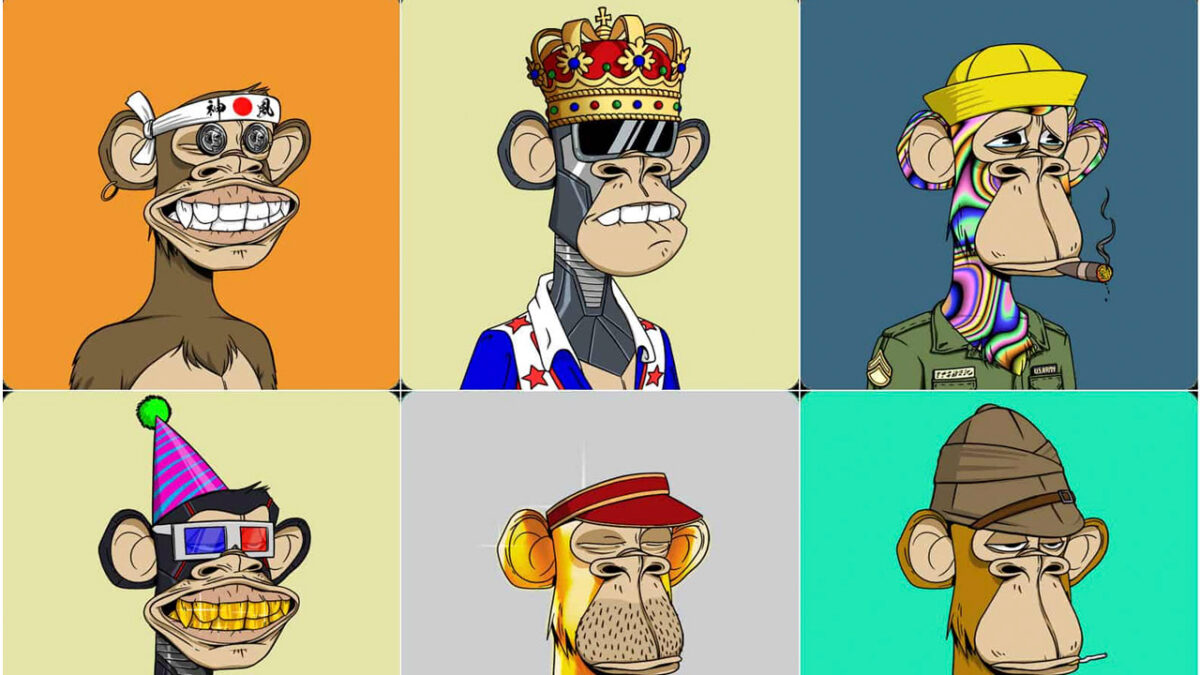

What are the similarities between Paris Hilton, Jimmy Fallon, Steph Curry, and Eminem? They’re all members of the Bored Ape Yacht Club, which means they’ve each purchased one of 10,000 ape avatar NFTs with various qualities and attributes. With Jimmy Fallon as the newest entry, he purchased the NFT with the captain’s hat at more than $200,000.

The Bored Ape Yacht Club (BAYC) has attracted a lot of attention and has had a lot of success. The Bored Apes collection of NFTs has been the most popular collection of NFTs in terms of trading volume and value since its original release in April 2021. Unsurprisingly, the number of well-known celebrities who “aped-in” grew over time. Today, we’ll take a look at their Ape collection.

EARLY ADOPTERS

- Steve Aoki

The EDM artist is a die-hard NFT supporter. He has spent more time engaging with NFTs than other celebrity Ape owners, and he has his own NFT collection. He was one of the first Ape adopters, purchasing BAYC #8716 for 49 ETH, and now has more than ten different Bored & Mutant Ape combos.

- Gary Vee

GaryVee (a.k.a. Gary Vaynerchuk) is another NFT fan, like Steve Aoki. He has always been a strong supporter of NFT and its applications. He “aped-in” unusually early, according to a tweet, and was probably minted from launch. He presently has three Bored Apes, #1452, #7912, and #8106, as well as his personal VeeFriends NFT collection.

- Dez Bryant

Dez Bryant was one of the first athletes to join the club, receiving Ape #2902 in the summer. The Ape #2902 was most likely given to him as a present at the time, and it was worth roughly 10 ETH. It is currently valued roughly $250,000. It is currently around 60 ETH.

- Marshmello

The EDM DJ was one of the first to use NFTs. He also owns CryptoPunk and has released various NFT collections for his admirers in addition to the Bored Ape. His Ape, #4808, is a rare one that cost him 75 ETH at the time of purchase but is now worth over 150 ETH.

SPORTS ATHLETES

- Mark Cuban

Mark Cuban, the billionaire investor and entrepreneur, is no stranger to the NFT space. He was given the Bored Ape #1597 as a gift, and it is now worth almost $250,000.

- Steph Curry

With Ape #7990, the Golden State Warriors’ star shooter has aped into the Bored Ape Yacht Club. The Ape set him back 55 ETH, or around $180,000, or 0.39 percent of his $45.7 million salary next season.

- LaMelo Ball

In early June 2021, LaMelo purchased an Ape. His first, Ape #7226, was purchased for 1.2 ETH in May, and his second, Ape #598, was purchased for 1.75 ETH a few weeks later.

- Shaquille O’Neal

The Mutant Ape #14452 was “aped-in” by the retired NBA great and celebrity influencer at the start of the fourth quarter of 2021. He paid 4.8 ETH (about $20,000) for the Ape.

- Von Miller

Von Miller, a linebacker for the Los Angeles Rams, purchased Bored Ape #4733 for 25 Ethereum. Miller also has Ape #1432, which was presumably given to him as a gift by NFL player Dez Bryant.

- Neymar Jr

Neymar Jr., widely regarded as one of the top soccer players in the world, also has the most Twitter followers of anyone on this list. On January 20, 2022, he made a major entrance into the Bored Ape Yacht Club, purchasing two Apes for a total of almost $1 million in ETH. Bored Ape #6633, a bubble-blowing pink ape with holographic spectacles and a party hat, proclaimed his existence to his 55 million followers. He also has the #5269 with the laser eyes.

- Serena Wiliams

The 23-time Grand Slam tennis champion was introduced to NFTs by her husband, Reddit co-founder Alexis Ohanian, a big supporter. He paid $414,000 in ETH for her Bored Ape #5797, which she subsequently uploaded on Twitter on January 20 with the phrase “GM.”

Ohanian had previously purchased a Serena-like CryptoPunk for his wife. Williams, meantime, just become a board advisor for the crypto fantasy soccer game Sorare.

From Entertainment and Business

- Lil Baby

In his NFT collection, American rapper Dominique Armani Jones, better known as Lil Baby, has both a Mutant Ape and a Bored Ape. He told his 5.8 million Twitter followers about his purchases, and his Mutant Ape is now his Twitter profile photo. Lil Baby paid 38 Ethereum for his Mutan Ape #10259, which is currently valued roughly 70 Ethereum, or $300,000.

- Jimmy Fallon

Jimmy Fallon, star of The Tonight Show, just joined the Bored Ape Yacht Club. On the 12th of November 2021, he purchased the Bored Ape #599 for 46.6 ETH and immediately used it as his Twitter profile photo.

- Post Malone

Post Malone, a singer and musician, recently paid over $700,000 for two Bored Ape Yacht Club NFTs. His purchase is featured in The Weeknd’s most recent song video. On Twitter, Post Malone is now using his Bored Ape #961 as his profile image.

- Future

In November 2021, rapper Future joined BAYC. Bored Ape #4672 was purchased for 48.88 ETH (about $222,000). Future has been flaunting his NFTs on Twitter, and he appears to be very enthusiastic about what’s to come.

- The Chainsmokers

The Chainsmokers, an American DJ duo, were among the first celebrities to own a Bored Ape Yacht Club NFT. The Duo bought this Cheetah Fur Bored Ape #7691 for 55 Ether and uses it as their Twitter profile photo.

- Snoop Dog

Snoop Dogg, an American rapper and NFT collector, possesses a complete set of BAYC, MAYC (M1 and M2), and a Bored Ape Kennel Club. “When I APE in, I APE all the way in!!” Snoop Dogg stated in the announcement tweet, and he wasn’t lying.

- Eminem

Marshall Mathers a.k.a. Eminem, an American musician, bought around $462,000 for the BAYC #9055, in which the Bored Ape resembles the artist. As of lunchtime Monday, his Shady Holdings pseudonym on OpenSea owned 22 NFTs, including eight purchased at the start of the year.

- KSI

KSI, a YouTube sensation and rapper, quickly fell into the NFT trap. In August 2021, he bought his first NFTs, and two days later, he’d launched a Twitter alt account (@ksicrypto) solely to NFTs, boasting about how much his Bored Ape had appreciated in value. Banks, another NFT aficionado and co-founder of the prominent gaming organization FaZe Clan, assisted KSI in his ape-in.

- Mike Shinoda

The Linkin Park rapper and solo artist not only collects NFTs and displays them on his Audius page (which includes a slew of Mutant Apes), but he also makes his own. Shinoda has launched a number of NFTs, most notably through the now-defunct Tezos store Hic et Nunc. He also streams on Twitch on a regular basis and distributes NFTs of artwork generated live, and he is optimistic about the future of cryptocurrency.

- Rich the Kid

Rich the Kid, a rapper, is swiftly moving into the NFT market, having purchased his first Bored Ape in early November and asking his fans if his Ape should “drop a music video.” He also mentioned buying NFT-based land in The Sandbox, a forthcoming Ethereum-based metaverse game. In September, he released his own NFT project, Rich Kids.

- DJ Khaled

DJ and music producer DJ Khaled joined the Bored Ape Yacht Club in November after purchasing Bored Ape #7380 with more than $227,000 in ETH via MoonPay. DJ Khaled’s Ape, which comprises a vivid tropical clothing and coins over his eyes, is his Instagram avatar as of this writing, with over 27 million followers.

- Paris Hilton

Paris Hilton, a reality TV personality and socialite, was a pioneer in the NFT area, selling her own blockchain-based artwork in 2020, years before the great majority of the persons on this list. While it may come as a surprise to see her become a proponent of NFTs, even giving some away on “Late Night With Jimmy Fallon,” she has the crypto credentials.

Hilton appeared on “Late Night” in January and displayed Bored Ape #1294, which she purchased with MoonPay for $287,000 in ETH. She joked about Fallon’s monkey and her own, saying, “They look like they could be pals.”

- Justin Bieber

On January 29, international pop sensation Justin Bieber jumped in with Bored Ape #3001, which sold for 500 ETH ($1.3 million). Crypto influencers like Gmoney and Farokh believe he overpaid, although it’s possible Bieber simply liked the look of this Ape with common characteristics. Bieber, who has 114 million Twitter followers, posted the image to his Instagram account using words from his hit “Lonely.” He also has NFTs from Doodles and World of Women, among other ventures, in his wallet.

- Meek Mill

MoonPay has supposedly engaged the help of yet another rapper to promote its NFT concierge service. MoonPay bought Bored Ape #6877 for almost $245,000 in ETH on January 1 and then transferred it to another wallet. Meek Mill was later caught on his phone showing it off while sitting next to BAYC holder Lil Baby. As of this writing, Meek has yet to change his Twitter image to his Bored Ape, but the number of MoonPay-backed celebrities is increasing.

- Logan Paul

Logan Paul, like his brother Jake, is a big fan of NFTs on social media. He tends to prefer CryptoPunks, owning many and even turning one into jewelry, but he also has a Bored Ape in his wallet—along with a slew of knock-offs that were likely delivered to his wallet without his knowledge. He has over 4,000 NFTs in his wallet, with a steady stream coming in from people who are most likely seeking to boost their projects.