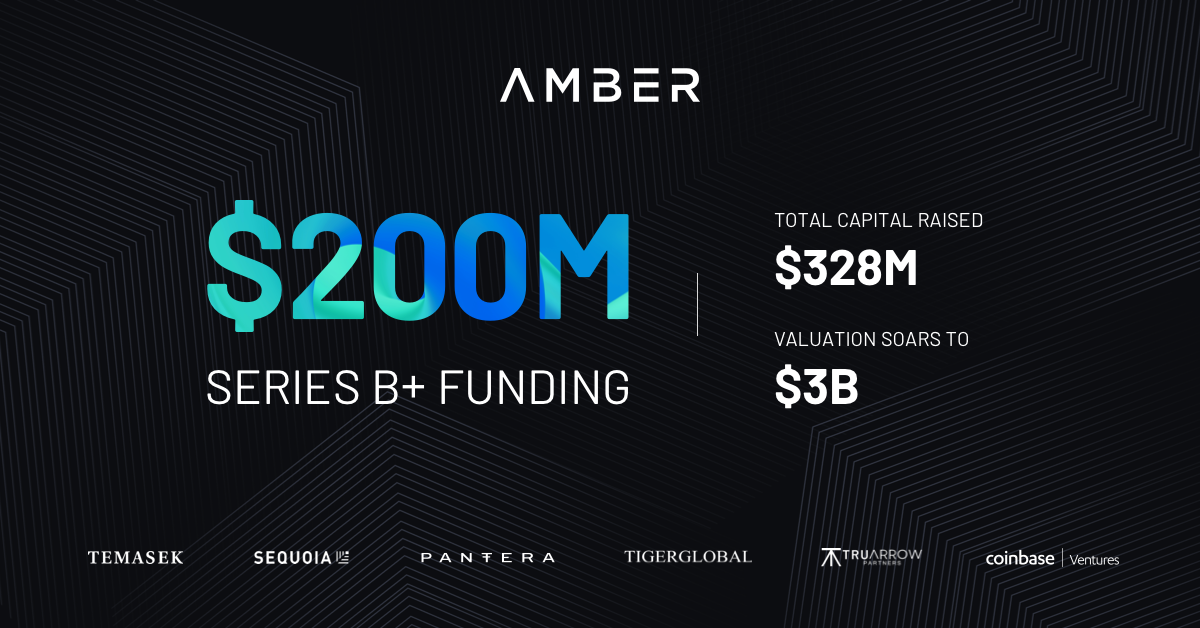

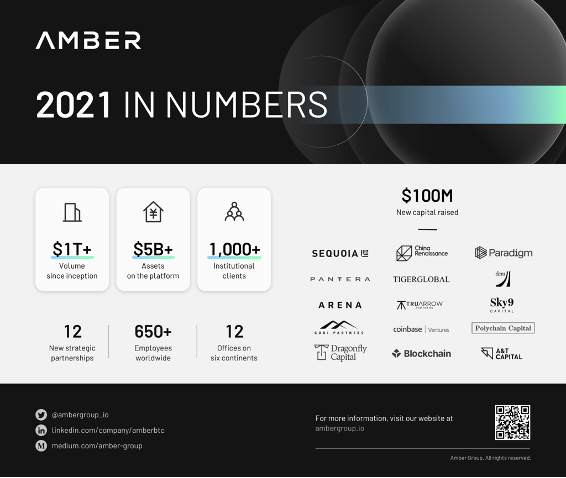

SINGAPORE, 22 February 2022 — Amber Group, a leading global digital asset platform, today announced a $200 million Series B+ round led by investment company Temasek, with participation from existing shareholders including Sequoia China, Pantera Capital, Tiger Global Management, Tru Arrow Partners, and Coinbase Ventures among others. A significant follow-up to Amber Group’s 2021 $100 million Series B round, this Series B+ round is the largest investment in Amber Group, valuing the company at $3 billion. Total capital raised at Amber Group now stands at $328 million.

This Series B+ round comes at a time of rapidly increasing digital asset adoption globally. The investment reinforces Amber Group’s strategic alignment with its investors, as well as a shared vision of digital assets’ future in a new, digital economy.

“From radically transforming the concept of ownership and value in the global economy, digital assets are redefining the way we live outside of the financial ecosystem. At Amber Group, we want to do more than just enable mainstream digital asset adoption. We want to help create a digital future where digital assets empower people with the opportunity and agency to shape a better world for all. We are proud to have the support of our investors who not only share this vision but also put their capital and trust in us to achieve it,” said Amber Group’s Global Chief Executive Officer, Michael Wu.

Founded in 2017, Amber Group has developed expertise in servicing both institutional and consumer markets. With global operations across 12 cities, the Singapore-headquartered company is one of the world’s leading liquidity providers, offering clients services that include algorithmic execution, electronic and OTC market-making derivatives, structured products, and advisory services. Amber Group also offers an award-winning consumer app, WhaleFin, and a full set of creative services and infrastructure in its OpenVerse business.

Amber Group is experiencing tremendous global growth, with cumulative transaction volume surpassing $1 trillion and assets under management growing to over $5 billion since its inception. Amber Group’s institutional business continues to benefit from a strong systematic pricing framework and a focus on client service while the company’s consumer business, WhaleFin, allows mainstream investors to build wealth in the digital era, further democratizing access to the world of crypto finance. OpenVerse, Amber Group’s creator-focused venture, forms another key business pillar for the company as it launches support for creators, brands, and studios through its suite of services and digital infrastructure.

Amber Group’s industry leadership is reinforced by its commitment to upholding security and regulatory compliance. The company is among the first global digital wealth platforms to have achieved Service Organization Control (SOC) 2 compliance – an external, independent audit that benchmarks industry best practices in IT, security, and privacy controls. The company has also extended its list of licences after securing regulatory approvals from in-market financial authorities in Australia, the UK, Japan, and Switzerland. Amber Group is now expanding into new markets around the world through regulatory licensing and strategic acquisitions, such as the company’s latest acquisition of Japanese crypto exchange, DeCurret Inc.

“This latest round of capital will bring Amber Group to the next level. Besides making key hires to support our institutional business in Europe and the Americas where there have been tremendous interest from traditional financial institutions and large family offices, we plan to expand WhaleFin’s global footprint in both developed and developing markets worldwide and advance OpenVerse, which is already experiencing hyper-growth with a strong line-up of gaming studios, sports collectibles, digital artists and other partner brands. We will cast our sights beyond business expansion and strategic acquisitions too, as part of our commitment to building a sustainable future for all. We will continue to broaden our support of sustainability initiatives, with our recent partnership with the Whale and Dolphin Conservation (WDC) being only the start of this journey,” added Wu.

“Digital assets are becoming an increasingly important category to watch, especially for institutional investors. With investment in Amber Group’s previous round, we are impressed by the professionalism of Michael and his team, as well as their ability to execute, their growth and focus on compliance. We continue to invest this round and believe Amber Group has the potential to become a leading digital asset platform in Asian market,” said Steven Ji, Partner of Sequoia China.

“Since Tru Arrow’s initial investment in Amber Group in 2021, it has been apparent to us that the company is building a transformational, global digital asset institution. Amber Group shows leadership in the quality of its team, standard of its regulatory approach and scale of its ambitions. With this ongoing endorsement from some of the world’s leading investors, the company continues to deliver on its growth plan without compromising on the integrity of its core principles. As a global investment partnership of some of the world’s leading families and entrepreneurs, Tru Arrow is proud to redouble its commitment to Amber Group, and take our collaboration to a new phase of expansion,” said James Rothschild, Co-Founder and Managing Partner at Tru Arrow Partners.

“It’s been exciting to see Amber Group’s growth, as both an investor and a trading partner. When we originally invested in the company, we had high expectations – reality has exceeded our expectations. Their 24/7 global coverage team has helped Pantera execute over $1.1b in trades in 2021 and that continues to grow. The Amber Group team has done a phenomenal job building an institutional-grade platform and we’re proud to be a part of their story,” said Dan Morehead, Founder and Chief Executive Officer at Pantera Capital.

-END-

Media Contact

Stella Wang

pr@ambergroup.io

About Amber Group

Amber Group is a leading digital asset platform operating globally with offices in Asia, Europe, and the Americas. The firm provides a full range of digital asset services spanning investing, financing, and trading, servicing over 1,000 institutional clients and a growing number of individual investors worldwide.

For more information, please visit www.ambergroup.io.