Russian President Vladimir Putin dispatched troops to Ukraine on February 23 dubbing the move a “special military operation”. Despite worldwide censure, Putin continues to press on, promising “consequences you have never seen” for countries that choose to interfere.

On Saturday, Ukraine’s official Twitter account made an unusual move by sharing its digital wallet addresses, where individuals could deposit bitcoin and ethereum, among other digital assets. The supported currencies include; Bitcoin, Etheruem and USDT which is pegged to the dollar.

As of this writing, here is the breakdown of how much has been received. You can track each of the donations by checking the statement here

See ETH statement here

According to Elliptic data, the addresses have received $14.8 million in donations so far, with bitcoin and ethereum accounting for the majority of the funds. Some people even donated NFTs of various values, including a “Mutant Floki,” to help the cause.

Ukraine’s government and other groups have raised a total of $22 million through over 23,000 crypto donations since the Russian invasion began. This says a lot about the role that crypto currencies will play in the near future. People are contributing as little as $1 to help this cause. The transactions are almost instantaneous, and the fees are significantly lower than those charged by wire transfers.

The process is really simple. For crypto transactions, all you need is the recipient’s crypto address which in this case has been shared by Ukraine in the tweet highlighted above. Transactions should be complete within 5 minutes. In contrast, for a wire transfer one would need; account name, account number, IBAN, bank address, recipients address, SWIFT CODE etc. In addition to that, the bank transactions take much more time due to internal bank systems.

How to donate to UKRAINE using UGX

Binance

- Sign up on Binance You can use the referral link for easier access

- Complete (Know your Customer) KYC; It is important for you to complete KYC as you will not be able to deposit your UGX without it.

After completing your KYC, that is when the action begins;

- Select “Deposit”.

2. Select “Cash” and Search for “UGX”.

3. Click “Continue” and enter the amount. We recommend a minimum of UGX 65,000 Note that the minimum purchase amount is UGX 60,000.

4. Enter the amount you wish to donate.

5. Then enter your mobile money number and verify it using the OTP sent to you.

6. A prompt will be sent to you to verify the transaction by entering your mobile money Pin.

7. Give it about 10 mins for the funds to reflect on your Binance account.

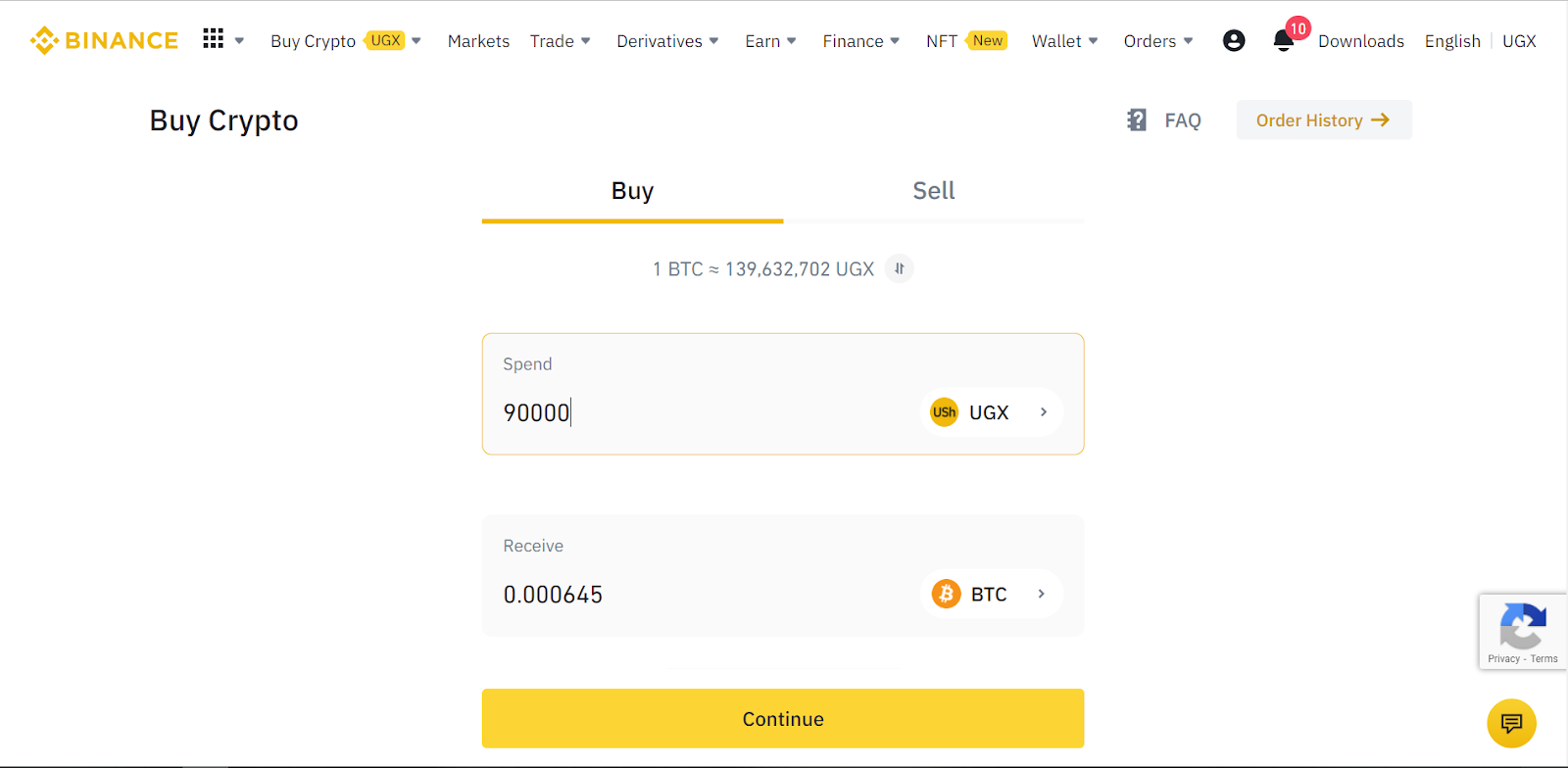

8. Now go to the home page and select “buy crypto > Credit/Debit”.

9. Select the currency you want to buy. For the sake of this donation, we shall select BTC.

10. Enter the amount you want to buy. It should be equal to your current deposit balance e.g UGX 63,000 (There is a 3% fee after depositing).

11. Select “Pay with Cash Balance” and confirm the transaction.

11. You have successfully bought BTC

After successfully buying Bitcoin, we can now send or donate it to UKRAINE. Here is how to do this;

a) Go to the home screen and select “wallet”.

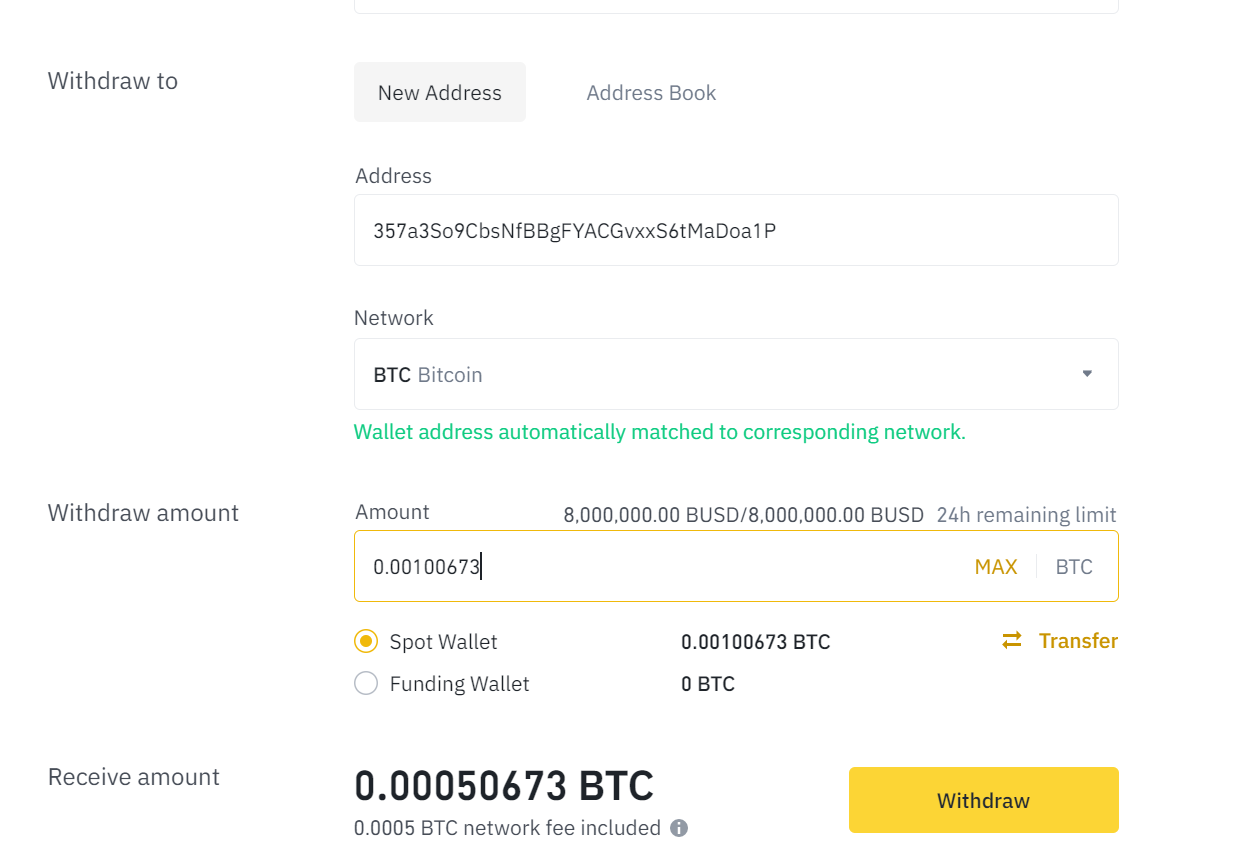

b) Select “Withdraw”.

c) Then select “BTC > Send via crypto network”.

d ) Copy the UKRAINE BTC address. Here is 357a3So9CbsNfBBgFYACGvxxS6tMaDoa1P

e ) Paste in the address section.

d ) Enter the amount of BTC you want to send. Be generous, select “MAX”.

g) Then select “withdraw”.

h) You will be required to complete Two Factor Authentication before you can withdraw for the first time. This is a one time process.

And just like that, you have helped and donated to Ukraine. This is where you can keep track of the transaction.

Yellow Card;

Steps to donating using Yellow Card

- Sign up or create an account on Yellow Card. You can use a referral link to make your work easier!

- Complete your KYC Verification; We encourage you to complete all four tiers of your KYC Verification. Tier 1 is passed by creating an account with the most minimal details. However, you are strongly advised to finish your Tier 2 and Tier 3 Verification in order to be able to transfer Bitcoin to Ukraine.

- Deposit Funds on your Yellow Card account. You can choose to deposit using mobile money or a bank transfer. We recommend that you use mobile money as it is instant and more convenient. However, the bank transfer option is also available for use.

4. Enter your mobile money number and verify it using the OTP sent to you.

5. A prompt will be sent to you to verify the transaction by entering your mobile money Pin.

6. Give it roughly 5 minutes for the funds to reflect on your Yellowcard account

7. Now go to the home page and select “wallet” and then select the buy option.

8. And in a snap of a finger, you have bought your bitcoin!

After successfully buying Bitcoin, we can now send or donate it to UKRAINE. Here is how to do this;

a) Go back to the home page and select “Wallet” and then “send”

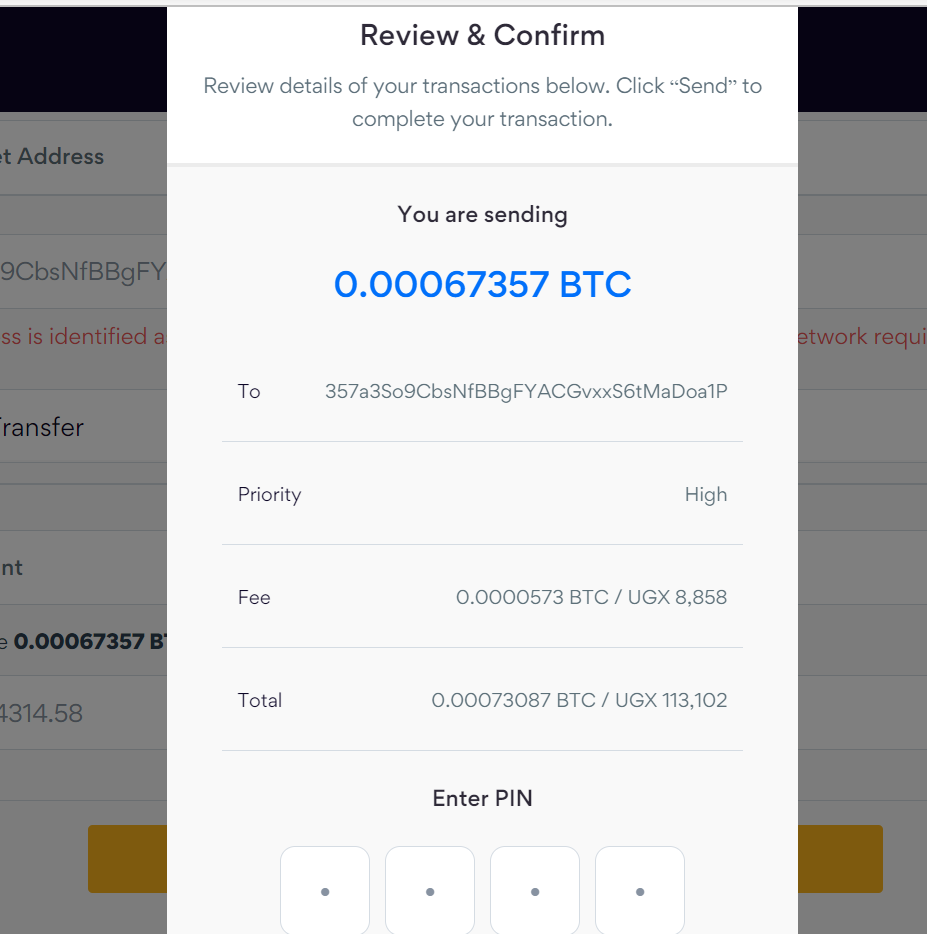

b) Insert the Ukraine BTC Address (357a3So9CbsNfBBgFYACGvxxS6tMaDoa1P). At this step, make sure you select the priority for your transaction.

c) Your purchase will be reviewed and you will be required to include your PIN to complete transaction

d) This is the last step, your transaction will be marked as successful.

Rather than wait to see what world nations are doing about the crisis in Ukraine, let us embark on doing our part on an individual basis. With as little as UGX 60,000/= and internet access, you can make a difference. Do not underestimate the power of one. Let’s start donating!