Cryptocurrency is a digital or virtual asset that is protected by encryption. Cryptocurrencies are decentralized, which means they are not controlled by governments or financial institutions. Many trading platforms, such as quick edge, are now assisting many successful cryptocurrency traders in making money through bitcoin trading. The cryptocurrency markets have emerged as one of the most fascinating venues for traders, and more people are getting involved in crypto trading every day. If you’ve found your way here, I’m guessing you’re looking to join their ranks. You’re in luck because you can learn everything you need to know to start trading prominent cryptocurrencies here.

In 2009, the first and most well-known cryptocurrency, Bitcoin, was founded. Thousands of different cryptocurrencies have been launched since then. Ethereum, Litecoin, and Bitcoin are three of the most popular.

Here are the basics of crypto trading.

Choose a Crypto Exchange for Trading

Once you’re ready to start trading cryptocurrencies your first job will be to find a suitable exchange. That might not be as easy as it sounds because there are different types of exchanges to consider and different regulations based on where you live.

The first consideration you must make is whether to use a centralized exchange (CEX) or a decentralized exchange (DEX). We recommend using a centralized exchange for beginners. It will be simpler to get started, and you will have access to more tools and resources. Decentralized exchanges are fantastic, and we adore them, but we believe they are not ideal for novice traders because they are difficult to use. Furthermore, the decentralized exchange will restrict you to trading only the coins supported by the DEX (Ethereum, Binance Smart Chain, etc).

There are a variety of cryptocurrency exchanges to select from, and you should read over their terms and conditions to get a sense of which one would best suit your needs. Some feature a larger assortment of cryptocurrencies, lower costs, and superior customer service.

Binance, Coinbase Pro, and Huobi are the top three exchanges at the time of writing.Binance will provide you with a larger range of coins to trade as well as significantly improved trading conditions. When it comes to choices and fees, Coinbase Pro (and the even simpler Coinbase) isn’t quite as good, but it’s a lot easier to use. Those who want the simplest way to buy and sell cryptocurrency can start with a basic Coinbase account and then upgrade to Coinbase Pro later.

Kraken, BitMex, Poloniex, and Gemini are among the other possible exchanges.

Many exchanges are still crypto-only, which means you won’t be able to deposit or withdraw fiat money.

Besides Crypto Exchanges, one may want to consider a crypto broker too. A broker is a person or business who works as a middleman in financial transactions. They are compensated for their aid in brokering transactions and purchases. Whereas the Coinbase Pro platform is an exchange, the well-known Coinbase is a broker. When compared to an exchange, broker fees are often relatively expensive.

On the plus side, cryptocurrency brokers provide a more acceptable atmosphere for people just getting started with bitcoin purchases and trading. They provide a way to buy crypto with fiat currency, as well as a way to convert crypto to fiat. The broker sets the prices, so there is no room for error, and buyers and sellers know exactly what they will get when buying and selling. Additional services, such as cold storage for huge sums of cryptocurrency, can be provided by brokers as well.

An exchange, on the other hand, connects buyers and sellers through an order book that contains the orders of all exchange members, as well as orders from outside sources. When compared with brokers, the exchange receives a significantly lower charge for their services because they are just connecting buyers and sellers. The exchange is basically a marketplace for buyers and sellers to meet.

The disadvantage is that in fast-moving markets, slippage can occur, resulting in buyers and sellers not receiving the price they expected.

Cryptocurrency exchanges are therefore appropriate platforms for advanced cryptocurrency holders and traders who seek to profit from price swings by speculating in the hopes of making profits and avoiding losses.

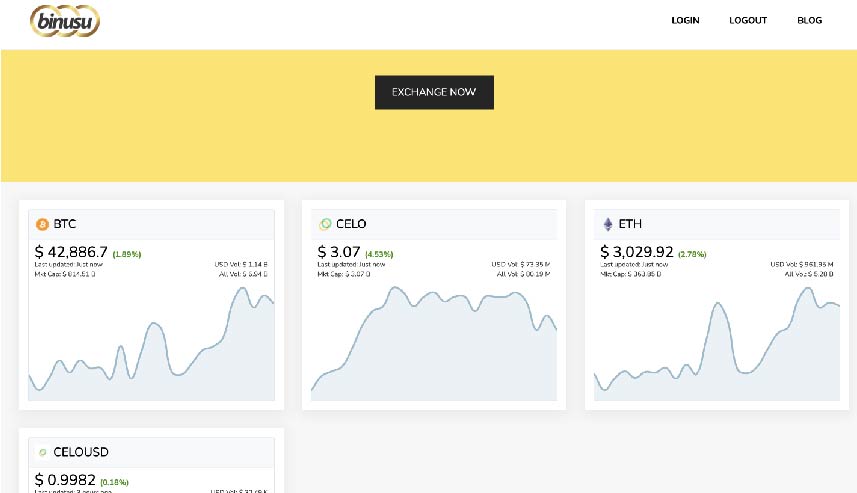

Choose The Cryptocurrency You Want To Trade

Of course, you need to decide which cryptocurrency you may want to trade in. Unfortunately, selecting a digital currency for trading may not be easy since there are plenty of cryptocurrencies to choose from. But, if you’re new to this trading market, you may consider trading in one of the well-known cryptocurrencies with a high market cap, such as Bitcoin, Ethereum, and XRP.

Make A Great Trading Strategy

Trading cryptocurrency isn’t just about exchanging a certain digital currency for another valuable asset. It’s also about generating more money as a result of your trading efforts. However, just like other forms of trading, dealing with cryptocurrency can be challenging.

Thus, if you want to ensure a successful trading experience with higher returns on your investment, you should have a solid trading strategy in place. And, as you consider your strategy, the following are a few things to keep in mind:

- Perform Your Own Research: When trading cryptocurrency, it’s essential to do your own research about the digital assets you’re buying to make sure they fit with your investment goals. The more you conduct your research, the more you familiarize yourself with the cryptocurrency you’re dealing with. As a result, you’ll know which one can provide you with higher returns. On the other hand, if you want to master the art of trading crypto with minimal research, then playing a crypto trading game can be an excellent idea. It allows you to make trades at no risks for fun while winning real cash prizes. Plus, you’ll get to know the cryptocurrencies right before entering the real trading platform.

- Only Invest What You Can Afford To Lose: Given the cryptocurrency’s volatile nature, the risk of loss of money is much higher compared to traditional trading of assets. Since these digital currencies can be affected by bugs and hacks, resulting in a decrease of their value, you may lose everything you invest. As such, it’s best to only invest the money you can afford to lose. That way, you can minimize the losses, but maximize your returns.

- Take Profits At Intervals: If you’re going to study the crypto market, you’ll find out that the values increase or decrease anytime. Hence, if you’re trading on a short-term basis and experience an increase in value, you may definitely want to know whether the value will increase more. However, the values of cryptocurrencies are volatile, and nobody knows if they’ll go up or down. This is one of the reasons why you should take profits at regular intervals. Doing so can make sure you’ll get steady returns.

- Stay Updated: Another important component of your trading strategy is to stay updated with the changing crypto market and the news regarding digital currencies. When you know what’s going on with the crypto you’re trading, you can ensure to make the most informed decisions as much as possible.

There is still a lot to learn about cryptocurrencies and how to trade them. While digital currencies are a popular asset in the financial market, they should be used with extreme caution to avoid severe losses. Therefore, if you’re new to crypto trading, keep the above guidelines in mind to ensure a smooth trading experience from start to finish.