Sub-Saharan Africa has emerged as the global leader in Bitcoin adoption, as revealed in the Chainalysis 2023 Geography of Cryptocurrency Report. The report, which recently unveiled a dedicated chapter focusing on the region, highlights the remarkable surge in Bitcoin usage across sub-Saharan Africa.

One of the standout findings is that homegrown cryptocurrency exchanges within the region continue to outperform their global counterparts. In particular, Nigeria, with a notable 9% growth rate, stands out as one of only six countries worldwide where Bitcoin transaction volume witnessed year-on-year growth. This trend has been further accelerated by the Naira crisis, which has fueled the adoption of cryptocurrencies. Chainalysis charts how interest in Bitcoin and stablecoins has soared in response to the devaluation of the Naira.

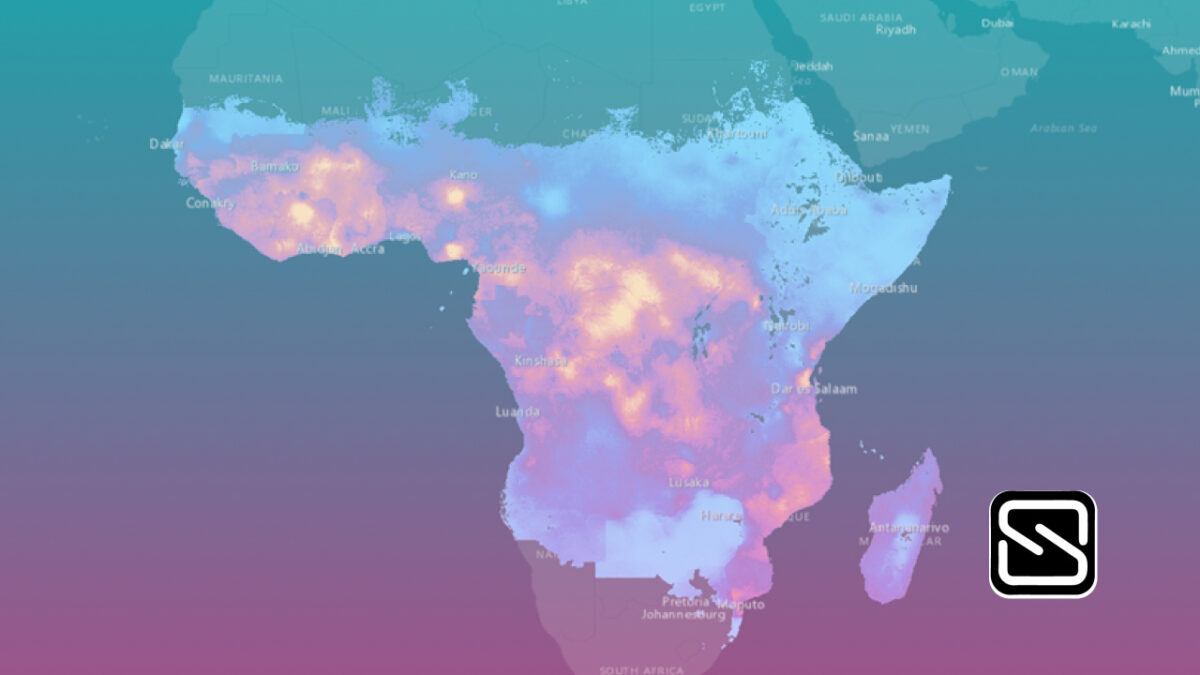

While sub-Saharan Africa maintains the smallest crypto economy among all regions, accounting for just 2.3% of global transaction volume between July 2022 and June 2023, the region received an estimated $117.1 billion in on-chain value during that period.

However, a deeper analysis reveals that cryptocurrency has made significant inroads into key markets within the region and has become an integral part of many residents’ daily lives. Nigeria ranks second overall on the Global Crypto Adoption Index, with Kenya (21), Ghana (29), and South Africa (31) also performing strongly on the index.

Notably, in no other region is Bitcoin as dominant as it is in sub-Saharan Africa, where it constitutes a larger share of transaction volume than anywhere else globally. Sub-Saharan Africa’s residents are increasingly turning to Bitcoin as a form of “digital gold” and an alternative store of value. Many countries in the region have grappled with rising inflation and debt, making cryptocurrency an attractive option for preserving savings and achieving greater financial freedom.

The recent surge in regulatory clarity through the enactment of cryptocurrency legislation in several African countries has likely contributed to the growth of the local cryptocurrency industry. South Africa, in particular, has taken a proactive approach to regulation, reducing regulatory uncertainty and fostering a favorable environment for crypto trading. Luno, a leading cryptocurrency exchange, notes that investment is currently the predominant use case for crypto in South Africa. Over the past three years, the number of customers holding substantial crypto balances on Luno has increased by nearly 50%.

Moreover, Luno highlights that markets without regulatory bans tend to develop more responsibly, with exchanges operating transparently and engaging in productive interactions with regulators. This conducive environment bodes well for the continued growth of the cryptocurrency industry in sub-Saharan Africa.