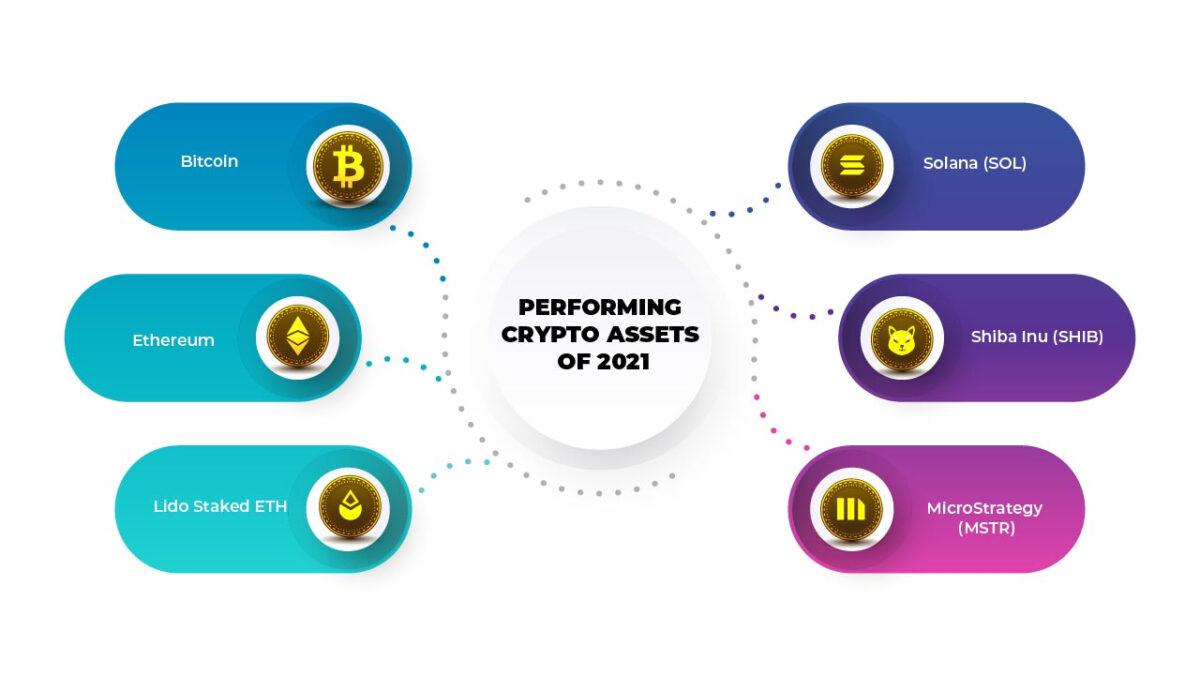

Crypto assets had a great start of the year, fell in June, rose again in September, and are now stuck in a rut as we approach the conclusion of 2021. Bitcoin and Ethereum, the two most valuable coins by market capitalization, both achieved all-time highs in 2021 and are expected to close the year up 67 percent and 450 percent, respectively, barring a massive fall in the final week of the year.

However, being at the top doesn’t leave much leeway for making the most significant advances over the course of a year. The year’s biggest crypto market winners were not BTC and ETH.

Data from CoinGecko and Yahoo Finance was used to determine the top performing assets. Assets that existed at the start of the year were used whenever possible. Because many of the coins at the top of CoinGecko’s ranking didn’t exist until 2021, there were some exceptions for firms who had their initial public offerings this year, such as Coinbase, and several meme currencies.

This is not investment advice; we do not recommend that our readers purchase these assets. However, their gains in 2021 are really intriguing.

DeFi token: Lido Staked ETH (stETH)

Market cap was chosen for the DeFi category of this list since it helps reflect how many individuals own the tokens as well as their price. In addition, the market capitalization of stETH has surged by 48,633 percent, from $12.3 million at the beginning of January to $6 billion as of December.

The Lido platform’s native coin for staked Ether is stETH. It enables users to stake their ETH without securing it in any way. When customers deposit ETH, the tokens are created and then burned when they are redeemed. The Lido DAO is in charge of the Lido platform’s staking protocols.

Runners up

Pancake Swap (CAKE), up 5,730%; Frax (FRAX), up 2,495%

Coin: Solana (SOL)

SOL’s price has risen 9,588 percent from January 1, rising from $1.84 to $178.26 per SOL as of 15th of December.

The Solana network’s native coin is SOL. It can be used to pay for staking and transaction fees. To validate transactions, the Solana network employs a proof of history method. Solana is Decrypt’s Coin of the Year due to the growth of not only the price of SOL, but also the development of the Solana ecosystem.

Runners up

Terra (LUNA), price up 9,391%; Dogecoin (DOGE), price up 3,179.54%

Meme Coin: Shiba Inu (SHIB)

SHIB’s stock price has gained 42,349,900 percent since January 1, rising from $0.00000000008 to $0.00003388 per share on December 15.

SHIB is an Ethereum-based ERC-20 token that was launched in August 2020. It was designed as a parody of DOGE, but it has easily exceeded the object of its satire to become the most popular meme coin–at least in terms of performance in 2021. Its price trailed Dogecoin by a large distance as of December 21, but anyone who bought SHIB at the start of the year would be looking at a staggering return.

Runners up

Dogecoin (DOGE), price up 3,180%; Dogelon Mars (ELON), up 2,368%

Publicly traded crypto company: MicroStrategy (MSTR)

MSTR stock has increased by 41% since January 1, rising from $425.22 to $598.59 per share as of December 15.

MicroStrategy, the business analytics and software firm founded by Bitcoin bull Michael Saylor, was not founded as a crypto firm. You may argue that it’s still not a crypto firm. However, its stock is now primarily a Bitcoin play. As of the company’s investor day on December 16, it has 122,478 Bitcoin in its treasury, and the corporate website has a dedicated Bitcoin section where it shares its business playbook on the world’s first cryptocurrency.

Runners up

Coinbase Global (COIN), shares down 20%; Block (SQ), shares down 21%

Publicly traded crypto-exposed company: Nvidia (NVDA)

NVDA’s stock price has gained 141 percent since the beginning of January, from $131.04 to $304.59 per share as of Dec. 15.

NVIDIA is a worldwide technology business that was created in 1993 (during the dot-com bubble). The NVIDIA CMP HX is one of the company’s dedicated graphics processing units (GPUs) utilized by crypto miners. Its earlier GPU, the NVIDIA GeForce RTX 2070, is also popular among crypto miners. Despite the fact that its crypto GPU line has consistently underperformed expectations, the company’s stock has had a fantastic year.

Runners up

Advanced Micro Devices (AMD), shares up 60%; Tesla (TSLA), up 24%

Publicly traded crypto miner: Marathon Digital Holdings (MARA)

MARA’s stock price has grown 252 percent from January 1, rising from $11.01 to $38.73 per share on December 15.

Marathon Digital is a Bitcoin mining firm with a 3.320 Exahash per second facility in Montana and offices in Las Vegas. The company was established in 2010 as the parent company of Uniloc, an Australian software startup. The corporation didn’t truly go into Bitcoin until 2021, when it bought a bunch of mining machines.

Runners up

Hut8 (HUT), shares up 183%; Bitfury (BITF), shares up 180%

Excerpt

Bitcoin and Ethereum, the two most valuable coins by market capitalization, both achieved all-time highs during the year and are expected to close the year up 67% and 450%, respectively, barring a massive fall in the final week of 2021.